Before we move to PAN Registration process in Nepal lets understand what Permanent account number is and why it is important to have one. Permanent account number in Nepali is स्थायी लेखा नम्बर.

What is Pan in Nepal?

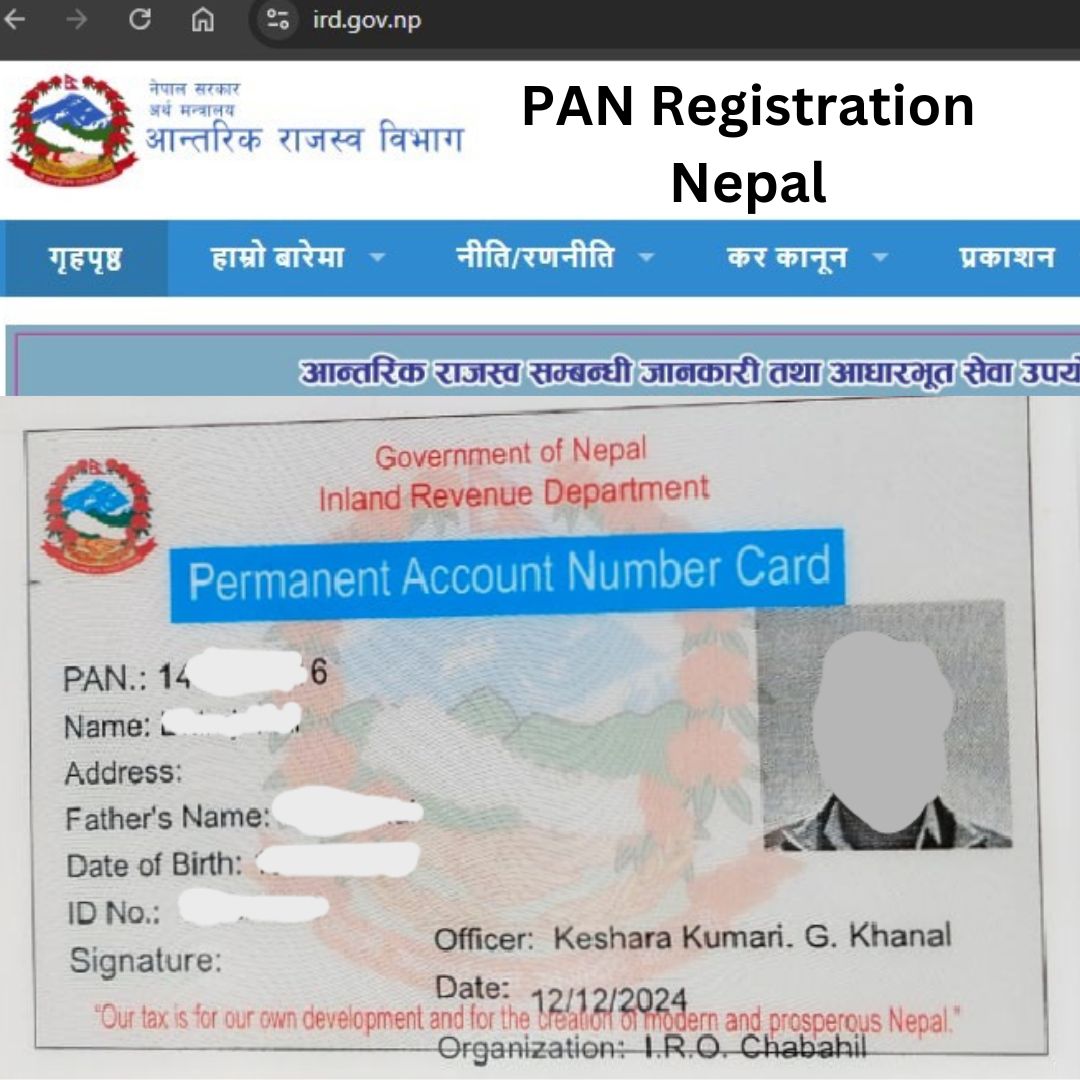

PAN Number (Permanent Account Number) is a unique 9-digit alphanumeric identification number issued by the Inland Revenue Department (IRD) under the Government of Nepal. It is used for tracking financial transactions and ensuring tax compliance. The PAN is mandatory for individuals, businesses, and organizations that engage in taxable activities or are required to file tax returns. PAN is important especially you are earning any amount in the country as it is directly connected with IRD Nepal and your income is considered as legal income.

Why do you need Pan in Nepal?

- Comply with tax laws of Nepal.

- Conduct financial transactions (banking, property, vehicles, etc.).

- Operate a business legally.

- Ensure transparency and accountability in financial activities.

Who needs to Register in Pan in Nepal?

- Individuals earning taxable income.

- Businesses, companies, and organizations.

- Property and vehicle buyers/sellers.

- Foreigners working or doing business in Nepal.

- Investors and professionals.

- Entities involved in large financial transactions or government contracts.

Documents to prepare before processing for Pan in Nepal

Individual Pan

- Citizenship Certificate

- Recent Passport-sized Photograph

- Valid visa and work permit for Foreigners (if applicable)

- Passport & Embassy Certificate for Foreigners (if applicable)

Business Pan

- Company Registration Certificate

- Memorandum and Articles of Association

- PAN/Citizenship documents of Directors/Partners

- Proof of Business Address/ Agreements

- Certificate from Social Welfare Council. (Applicable for NGO)

Cost of PAN Card Registration in Nepal

In Nepal, PAN card registration is free of cost for both individuals and businesses. The Inland Revenue Department (IRD) does not charge any fee for obtaining a Personal PAN or Business PAN.

How to register PAN in Nepal ? Permanent Account Number Registration Process Steps

In Nepal, obtaining a Permanent Account Number (PAN) is mandatory for individuals, businesses, and organizations involved in financial transactions. The Inland Revenue Department (IRD) issues PAN cards. Here’s how you can register for a PAN in Nepal:

Types of PAN Registration

· Personal PAN (Individual) – Required for salaried employees, self-employed individuals, and freelancers.

· Business PAN (Company/Firm) – Required for companies, firms, and organizations engaged in business activities.

PAN Registration Process

For Individuals (Personal PAN).

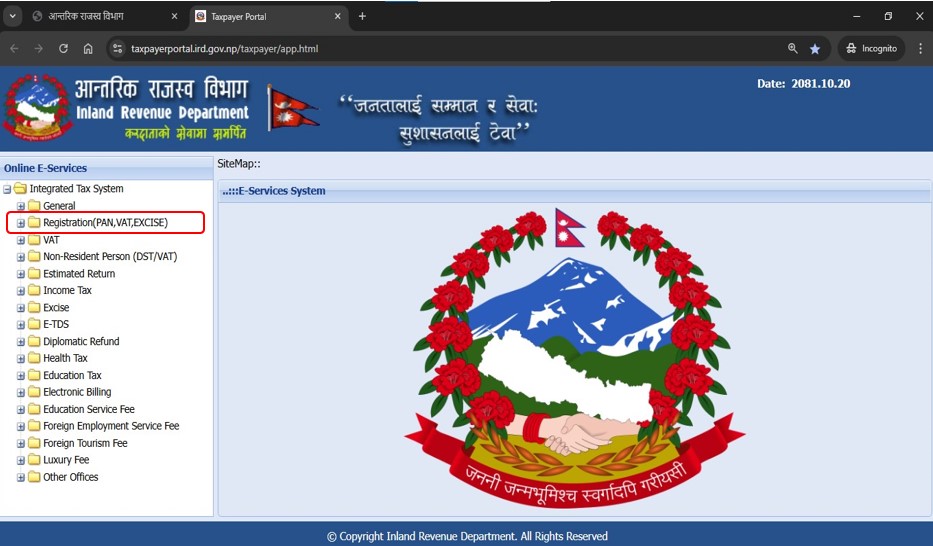

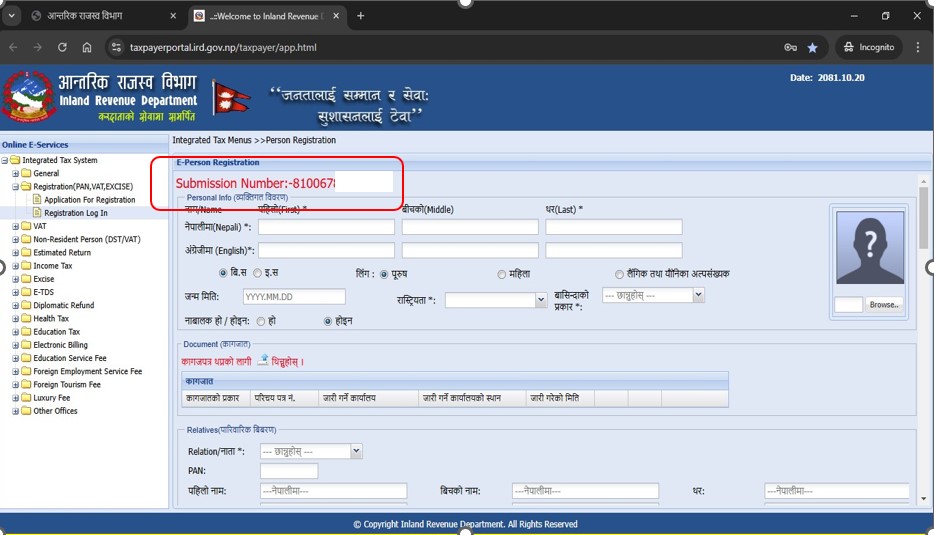

- Go to the “Taxpayer Portal” or click IRD official Site

- Click on “Registration (PAN, VAT, EXCISE) as shown in Pictures.

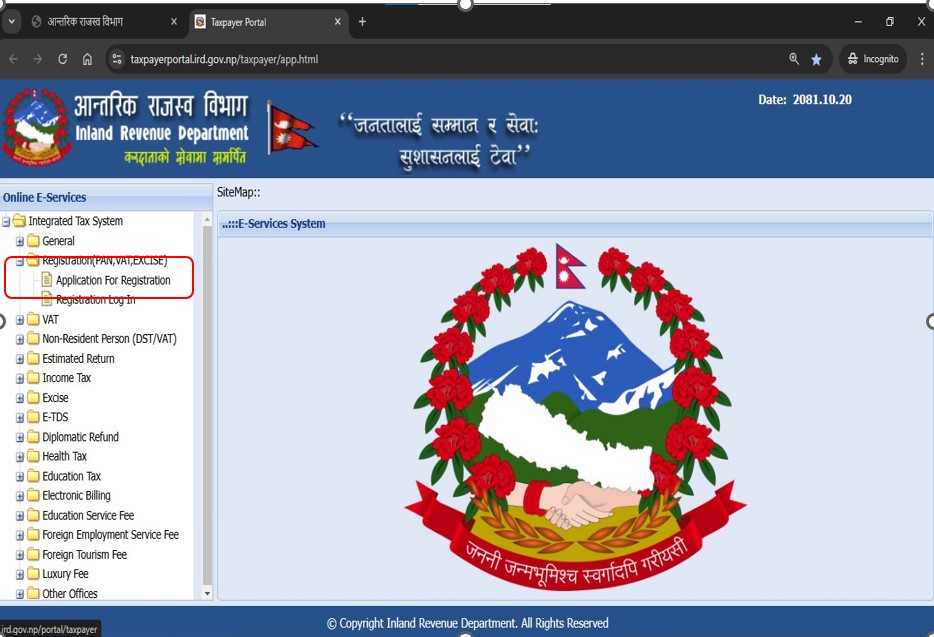

- Click on “Application for Registration” Permanent Account Number as shown in picture below

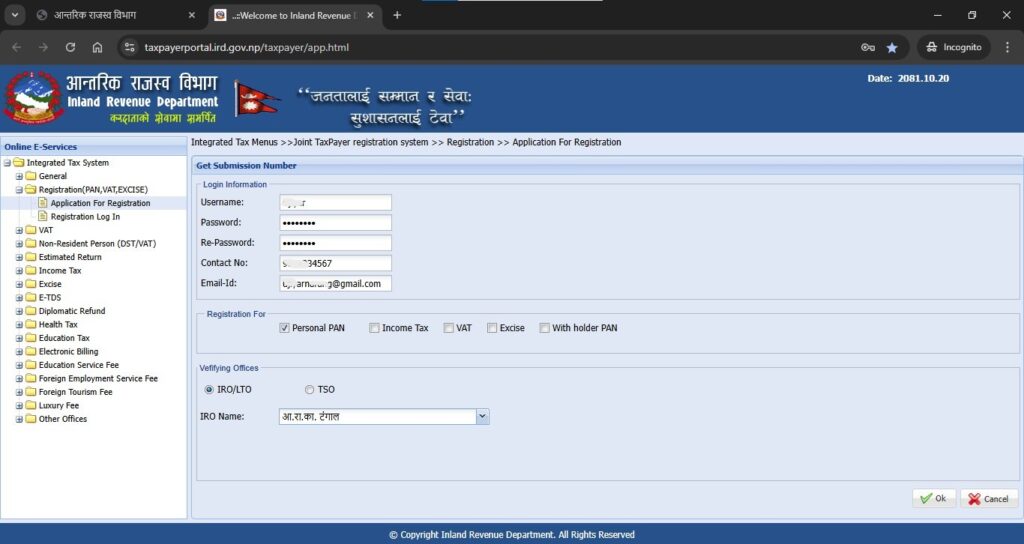

- Fill the “Login Information” (Username,Password, Contact no & Email ID)

- select “Personal PAN”

- Select “IRO Name” (Nearest Tax Office)

- Click “Ok”

As shown in picture below

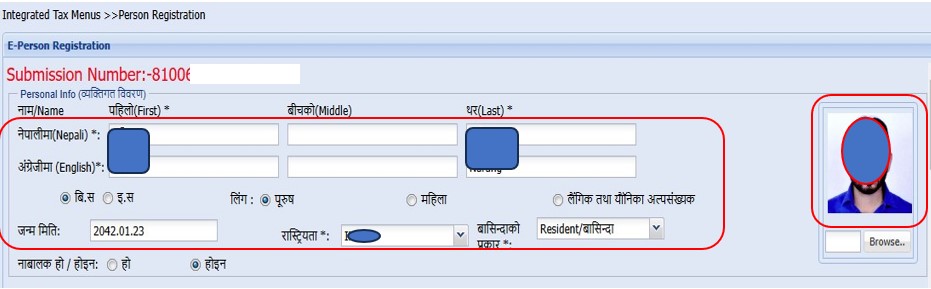

- You will see “New Submission Number.” (Save the Login Info & Submission No.)

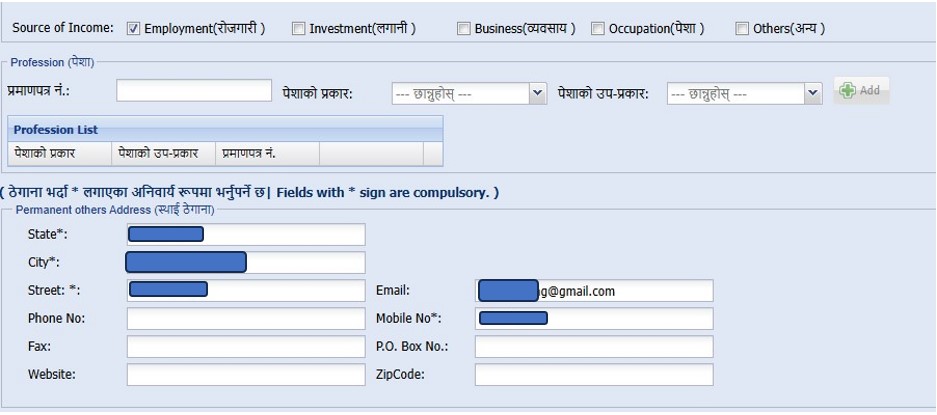

- Fill “Personal Info” ( * It is Mandatory to fill )Name, Date of Birth, Nationality, Gender & Resident/Non-Resident

- Upload Your “Digital Passport-size photo” Max 500KB Size

Resident means person who stays 183 days or more in Nepal during that Fiscal Year.

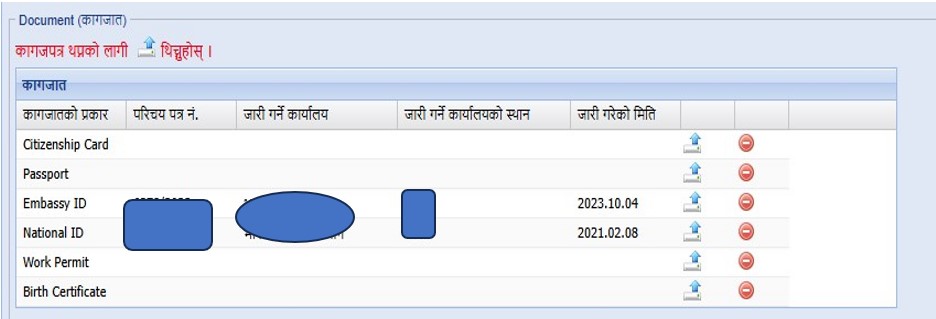

- Upload a scanned copy of your “Citizenship Certificate/National IDs

- Upload a scanned copy of your “Passport/Valid VISA” in case of Foreigners

- Upload a scanned copy of your “Embassy Certificate” in case of Foreigners

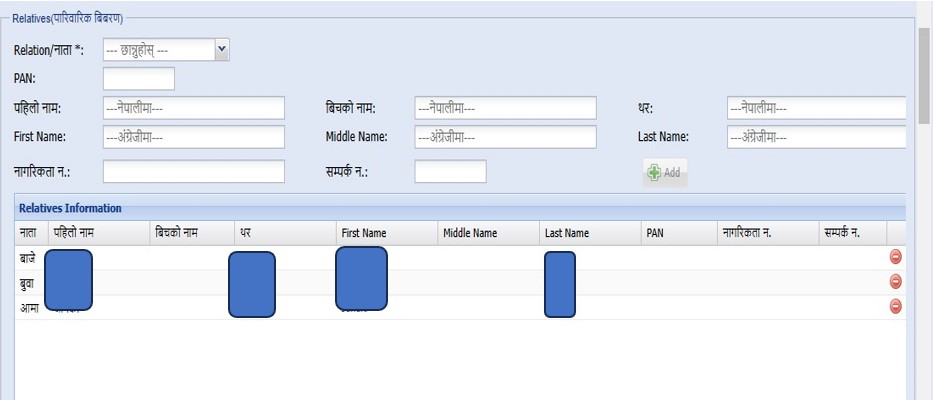

- Fill 3 generation “Family Details” (Grandfather, Father & Mother)

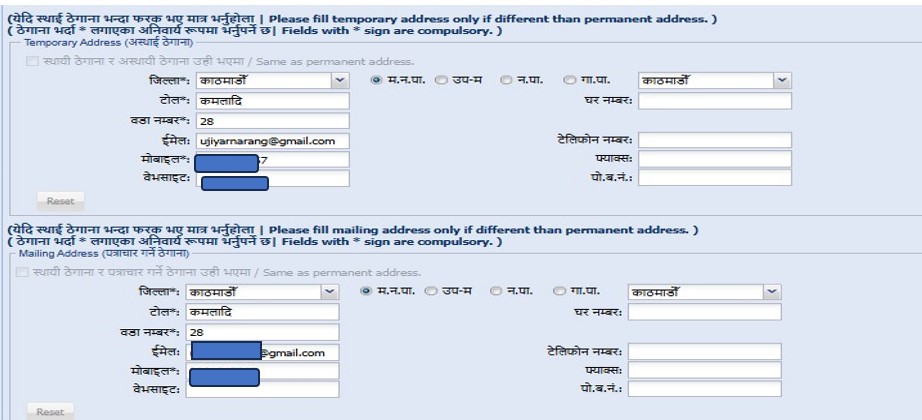

- Fill “Actual Address and contact information” . ( * It is Mandatory to fill )

- Correspondence address for communication, can be same for those who are citizen of Nepal.

- Bank Details are not Mandatory (leave It blank.)

- Select Preferred aleart service & Tick “SMS & Email”

- Submit the form and note down the Submission Number.

- After You submit the form To verify the registered mobile number and email address, a One-Time Password (OTP) is sent through the alert system. Follow the steps below:

a. Select the type of registered mobile number and email address verification.

b. Choose whether to verify via mobile or email. (Preferred Mobile No.)

c. Enter the OTP received on your mobile or email.

- Print the acknowledgment receipt after online submission & Visit your nearest Tax Office (IRD Office) with

- Original Citizenship Certificate/Passport

- Embassy Certicicate (Incase for Foreigners)

- Once verified, the Tax Office will issue your PAN card

Note:- All images used are from IRD site Nepal